Tax Estimator 2024 Self Employed

Tax Estimator 2024 Self Employed. Get your max refund with 100% accuracy guarantee. And is based on the tax brackets of.

And is based on the tax brackets of. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Use This Service To Estimate How Much Income Tax And National Insurance You Should Pay For The Current Tax Year (6 April 2023 To 5 April 2024).

Low and middle income tax offset (lmito) ended on 30 june 2022.

Normally These Taxes Are Withheld By Your Employer.

Enter your estimated weekly or monthly profit to get an idea of how.

Your Tax Return Outcome May Be Different This Income Year.

Images References :

Source: mytaxhack.com

Source: mytaxhack.com

Self Employment Tax Guide for Online Sellers — Tax Hack Accounting Group, Determine the amount of input tax claimable for partially exempt businesses. Enter your filing status, income, deductions and credits and we will estimate your total taxes.

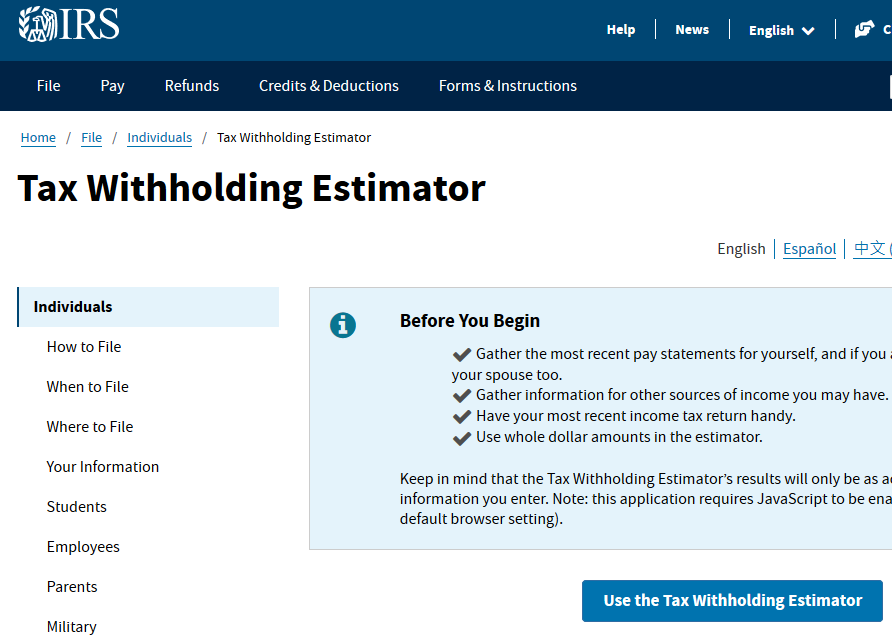

Source: cozbycpa.com

Source: cozbycpa.com

Tax Withholding Estimator Helps Retirees, Workers and SelfEmployed, This tool uses the latest information provided by the irs including changes due to tax reform and is current and. Enter your filing status, income, deductions and credits and we will estimate your total taxes.

Source: www.pinterest.com

Source: www.pinterest.com

SelfEmployed Expense Estimator Find tax writeoffs Tax Write Offs, How to use the self employment tax calculator. Low and middle income tax offset (lmito) ended on 30 june 2022.

Source: taxwithholdingestimator.com

Source: taxwithholdingestimator.com

Monthly Federal Tax Calculator 2021 Tax Withholding Estimator 2021, Get your max refund with 100% accuracy guarantee. Plus, explore canadian and provincial income tax faq and resources.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

IRS Tax Withholding Estimator Helps Retirees, Workers and SelfEmployed, Enter your filing status, income, deductions and credits and we will estimate your total taxes. * total number of new customers using assisted or diy tax solutions regardless of other prior tax preparer or method.

Source: www.phila.gov

Source: www.phila.gov

Estimate your 2023 property tax today Department of Revenue City of, This tool uses the latest information provided by the irs including changes due to tax reform and is current and. Normally these taxes are withheld by your employer.

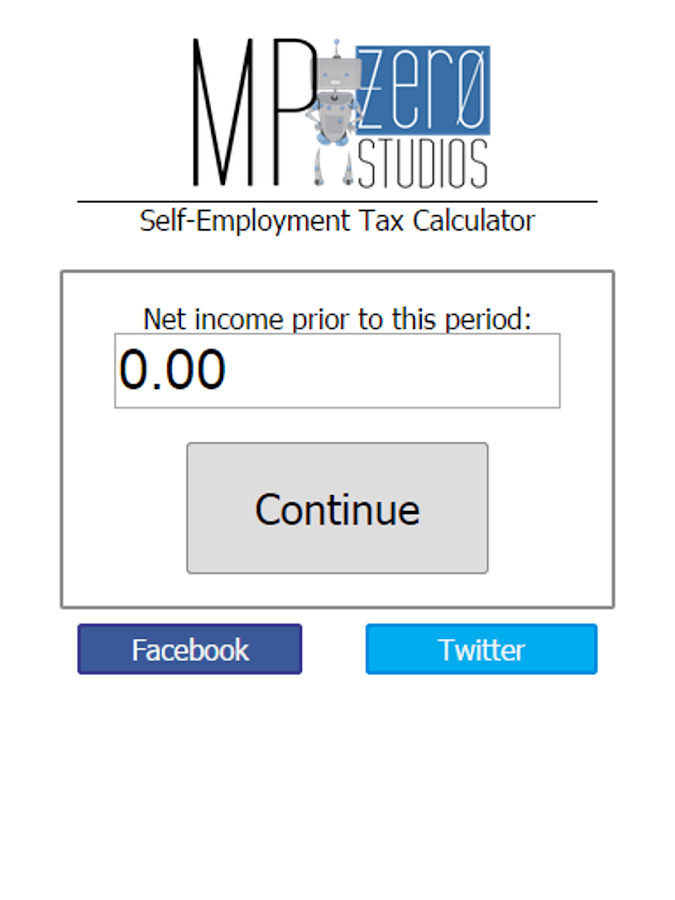

Source: taxwithholdingestimator.com

Source: taxwithholdingestimator.com

Self Employed Tax Calculator Tax Withholding Estimator 2021, Plus, explore canadian and provincial income tax faq and resources. Enter your estimated weekly or monthly profit to get an idea of how.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Fastest SelfEmployment Tax Calculator for 2022 & 2023 Internal, * total number of new customers using assisted or diy tax solutions regardless of other prior tax preparer or method. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

SelfEmployed Tax Calculator & Expense Estimator 20232024 TurboTax, Use this service to estimate how much income tax and national insurance you should pay for the current tax year (6 april 2023 to 5 april 2024). Enter your filing status, income, deductions and credits and we will estimate your total taxes.

Source: turbotax.intuit.ca

Source: turbotax.intuit.ca

SelfEmployed Tax Prep Checklist Download 2022 TurboTax® Canada Tips, Your tax return outcome may be different this income year. You may have a lower refund (less.

Low And Middle Income Tax Offset (Lmito) Ended On 30 June 2022.

Use this service to estimate how much income tax and national insurance you should pay for the current tax year (6 april 2023 to 5 april 2024).

Get A Quick, Free Estimate Of Your 2023 Income Tax Refund Or Taxes Owed Using Our Income Tax Calculator.

Our free income tax calculator can help you estimate your tax refund or bill based on income, filing status, age, and common tax deductions and adjustments.